This post may contain affiliate links. If a product or service is purchased using a link(s) in the post below a small commission may be earned.

Last updated on July 5th, 2024 at 11:38 am

header image provided by Pixabay

As we know fraud is everywhere and this isn’t something that I take lightly. It seems more and more people are being scammed and it’s happening quicker and quicker.

That being shared I found a new fraud attempt on a bank account. The new twist is that the fraud was being made for an investment app.

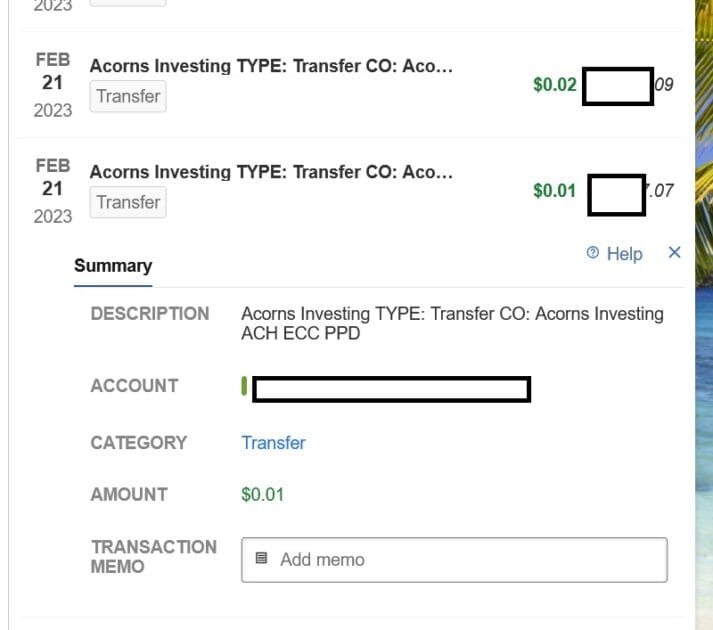

I check my statement often. I also make sure my parents’ stuff is up to date as well. While I was checking one of the bank accounts recently I came across some odd charges. The charges were small a few cents to start (under 5 cents) then jumped to $5.

All of these were a bit low to be detected by any real fraud or ID theft protection program. Which in my opinion isn’t right but I digress.

The charges

The charges started at the end of February. They started out small as most do. I think they were testing to see if the account was valid as well as if there would be any fraud alerts.

The first chargest happened in a cluster on the first day. In total it was 3 cents that were quickly transferred back to the brand.

You may be asking which brand was it. It was Accorns investing. I don’t use investment apps and neither do my parents. I didn’t think much of it. I thought maybe it was a banking-related option.

It gets worse

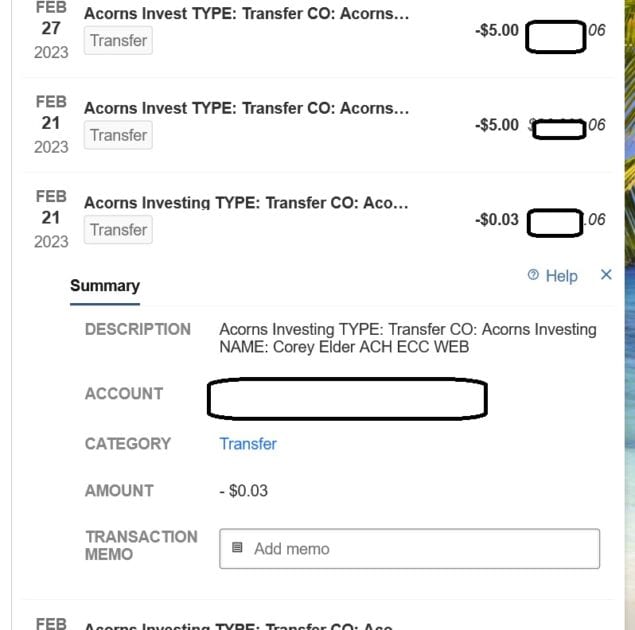

Once Accorns Investng learned the account was valid and had money in it. They allowed someone named Corey Elder to add a recurring deduction of $5.

It appears these $5 transfers were set up to happen weekly. They happened on February 21st and 27th as well as March 1st and the 6th. So the bank account was out $20.03 so far. I’m happy I caught it in time.

I have no idea who Corey Elder is or even if they exist. They could just be a name the scammers use to attach it to a bank account they skim.

How Was the account get captured?

I don’t know. This isn’t an account that is accessed often. I’m glad I caught the errors before it was much worse.

In past fraud attempts the sum of money was much large and it was trying to be transferred to the Japanese Yen.

What you can do if this happens to you

Contact your bank or financial institution as soon as possible. Many banks or Credit Unions will walk you through the steps of what needs to be done.

If you notice fraud such as this one where it starts out small never question it contact your financial institution as soon as you can.

You will probably be given a new account number and if you do online banking they will ask you to change your login info.

If your band or credit union offers fraud protection learn more about it. Granted this was considered low-key fraud because it was under $100 but it’s still worth looking into.

You can look into other protection such as LifeLock.

Always keep up to date on your account activity even if you log in once a week to check your statements.

The worst part about these types of fraud is that they are all done via bank transfers so there doesn’t need to be any proof of identity of the user just an account number that’s valid.